Work with a partner that matters

We're a Silicon Valley-based VC firm scaling mid-stage startups with hands-on operator expertise

Work with a partner that matters

We're a Silicon Valley-based VC firm scaling mid-stage startups with hands-on operator expertise

Work with a partner that matters

We're a Silicon Valley-based VC firm scaling mid-stage startups with hands-on operator expertise

We’ve invested in

About Us

Intelligence-Driven Team

We built R136 differently. We’ve spent 10+ years engineering a proprietary “Discovery Engine” to identify identifiable inflection points. This systematic approach allows us to recognize elite founders and market shifts before they reach consensus.

While most VCs offer capital and connections, we bring something rarer – battle-tested operating experience playbook from scaling 20,000+ person organizations, exiting 13 companies, and building 5 unicorns.

Portfolio Investments

40+

40+

Portfolio Exits

10+

10+

Portfolio Unicorns

6

6

At R136, we don’t just evaluate scale - we’ve lived it, several times. That's the difference between theory and experience. How to scale a tech team, sell to large enterprises, cut costs, or prepare for a new raise - we've been thought it all.

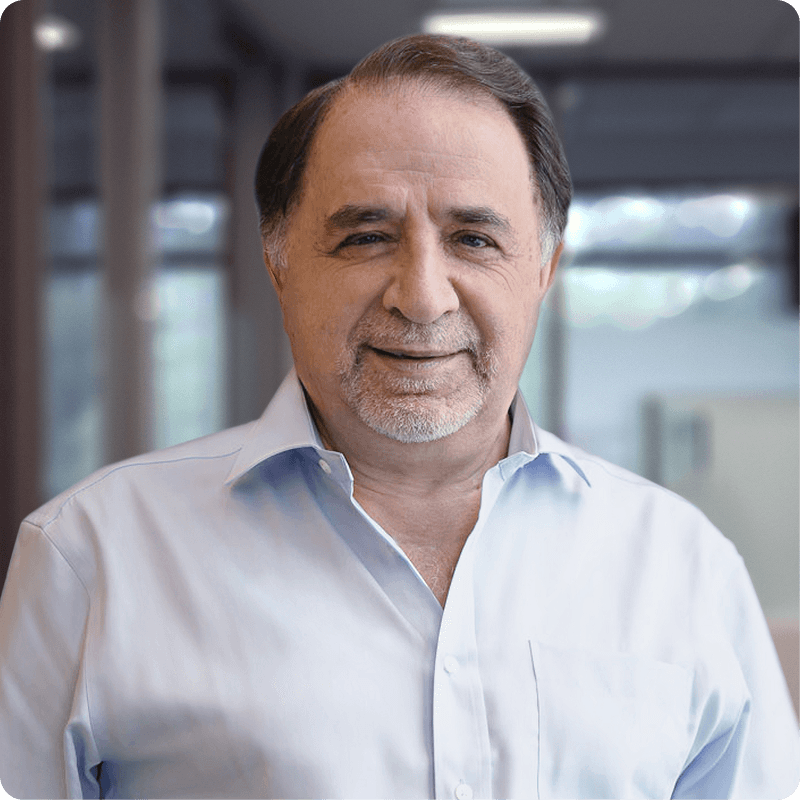

Victor Orlovski

Founding Partner

At R136, we don’t just evaluate scale - we’ve lived it, several times. That's the difference between theory and experience. How to scale a tech team, sell to large enterprises, cut costs, or prepare for a new raise - we've been thought it all.

Victor Orlovski

Founding Partner

At R136, we don’t just evaluate scale - we’ve lived it, several times. That's the difference between theory and experience. How to scale a tech team, sell to large enterprises, cut costs, or prepare for a new raise - we've been thought it all.

Victor Orlovski

Founding Partner

Founders

Who Think Differently

Founders

Who Think Differently

Our 40+ portfolio companies challenge conventional thinking in B2B tech, fintech, and AI. We back founders who see opportunities others miss and have the courage to pursue them.

Full Portfolio

The global payments and financial platform for growing businesses

The global payments and financial platform for growing businesses

FinTech

FinTech

Singapore

Singapore

Portfolio

Portfolio

Deep-learning platform for building next-generation AI systems

Deep-learning platform for building next-generation AI systems

AI Ops

AI Ops

Israel

Israel

Acquired

Acquired

Provider of a social trading and investing platform

Provider of a social trading and investing platform

FinTech

FinTech

Israel

Israel

IPO

IPO

Insurance comparison marketplace for auto, home, and life policies

Insurance comparison marketplace for auto, home, and life policies

InsurTech

InsurTech

US

US

Portfolio

Portfolio

Global platform for ride-hailing, food delivery, and freight services

Global platform for ride-hailing, food delivery, and freight services

MobilityTech

MobilityTech

US

US

IPO

IPO

Investing

With Conviction

Investing

With Conviction

We focus on the critical inflection point where execution matters as much as great products, and we invest across any combination of these stages, geographies, and ownership targets.

Geographies

Core markets: The US, Israel

Other markets: Europe, Latam, Middle east for emerging opportunities

Key Focus Area

Enterprise & B2B SAAS

HR, Marketing

Mobility & Logistics

Fintech

Edutech

B2B Ecommerce & Marketplaces

AI/ML Enablers

Workflow Automation

Data & Analytics

Cybersecurity

Investment Stage

Mid stage (Late Series A - Series B)

Growth stage (Series C+)

Investment Size

Mid stage investment of $2M-10M

Growth stage investment of $10M-20M

Geographies

Core markets: The US, Israel

Other markets: Europe, Latam, Middle east for emerging opportunities

Key Focus Area

Enterprise & B2B SAAS

HR, Marketing

Mobility & Logistics

Fintech

Edutech

B2B Ecommerce & Marketplaces

AI/ML Enablers

Workflow Automation

Data & Analytics

Cybersecurity

Investment Stage

Mid stage (Late Series A - Series B)

Growth stage (Series C+)

Investment Size

Mid stage investment of $2M-10M

Growth stage investment of $10M-20M

The Unfair Advantage We Bring

We don't just write checks — we roll up our sleeves with proven frameworks, deep expertise, and actionable insights to help you win

Commitment

We act as an active partner throughout the company lifecycle, providing expertise in GTM, product strategy, org design, hiring, and financial planning. We deliver market intelligence, support founder decisions, and offer operational guidance whenever needed.

Research Framework

The R136 Research Framework™ provides deep, structured market intelligence. Our internal team maps value chains, evaluates sector economics, analyzes competitors, and identifies emerging tech trends — uncovering high-potential opportunities early.

Scale & Partners

We connect startups with the right clients, partners, and investors. Our team of 14 has supported 20+ enterprise clients, secured Tier-1 partnerships, facilitated $300M+ in external funding, and recruited top talent across product, engineering, and operations to scale effectively.

Sourcing Framework

The R136 Sourcing Framework™ blends data-driven discovery with targeted founder outreach. We identify exceptional teams before fundraising, using structured industry mapping and signal tracking, giving us access to unique, pre-competitive opportunities.

Local Presence

With hubs in Silicon Valley, Israel, UAE, Central Asia and Europe, we combine local insight with global reach. We help founders navigate regulatory nuances, competitive landscapes, and first business development engagements to enter new markets efficiently and successfully.

Validation Framework

The R136 Validation Framework™ runs full-spectrum diligence: founders, board dynamics, GTM, financials, product, and tech. This operationally informed analysis reduces risk, accelerates post-investment execution, and ensures long-term value creation.

Commitment

We act as an active partner throughout the company lifecycle, providing expertise in GTM, product strategy, org design, hiring, and financial planning. We deliver market intelligence, support founder decisions, and offer operational guidance whenever needed.

Scale & Partners

We connect startups with the right clients, partners, and investors. Our team of 14 has supported 20+ enterprise clients, secured Tier-1 partnerships, facilitated $300M+ in external funding, and recruited top talent across product, engineering, and operations to scale effectively.

Local Presence

With hubs in Silicon Valley, Israel, UAE, Central Asia and Europe, we combine local insight with global reach. We help founders navigate regulatory nuances, competitive landscapes, and first business development engagements to enter new markets efficiently and successfully.

Research Framework

The R136 Research Framework™ provides deep, structured market intelligence. Our internal team maps value chains, evaluates sector economics, analyzes competitors, and identifies emerging tech trends — uncovering high-potential opportunities early.

Sourcing Framework

The R136 Sourcing Framework™ blends data-driven discovery with targeted founder outreach. We identify exceptional teams before fundraising, using structured industry mapping and signal tracking, giving us access to unique, pre-competitive opportunities.

Validation Framework

The R136 Validation Framework™ runs full-spectrum diligence: founders, board dynamics, GTM, financials, product, and tech. This operationally informed analysis reduces risk, accelerates post-investment execution, and ensures long-term value creation.

Commitment

We act as an active partner throughout the company lifecycle, providing expertise in GTM, product strategy, org design, hiring, and financial planning. We deliver market intelligence, support founder decisions, and offer operational guidance whenever needed.

Local Presence

With hubs in Silicon Valley, Israel, UAE, Central Asia and Europe, we combine local insight with global reach. We help founders navigate regulatory nuances, competitive landscapes, and first business development engagements to enter new markets efficiently and successfully.

Sourcing Framework

The R136 Sourcing Framework™ blends data-driven discovery with targeted founder outreach. We identify exceptional teams before fundraising, using structured industry mapping and signal tracking, giving us access to unique, pre-competitive opportunities.

Scale & Partners

We connect startups with the right clients, partners, and investors. Our team of 14 has supported 20+ enterprise clients, secured Tier-1 partnerships, facilitated $300M+ in external funding, and recruited top talent across product, engineering, and operations to scale effectively.

Research Framework

The R136 Research Framework™ provides deep, structured market intelligence. Our internal team maps value chains, evaluates sector economics, analyzes competitors, and identifies emerging tech trends — uncovering high-potential opportunities early.

Validation Framework

The R136 Validation Framework™ runs full-spectrum diligence: founders, board dynamics, GTM, financials, product, and tech. This operationally informed analysis reduces risk, accelerates post-investment execution, and ensures long-term value creation.

Your Partners

For Growth

Your Partners

For Growth

R136 is led by a team of partners who possess unique expertise and experience in building and operating some of the largest companies in the world.

Let Our Founders

Speak For Us

Behind every great company is a partner who sees potential before it’s obvious. Hear from the founders who scaled with R136 by their side.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Liad Agmon

Founder and CEO of Dynamic Yield

Acquired

The investment was made in 2018 after a swift and streamlined process: Victor quickly grasped our distinctive value proposition, solution, and market potential, expressing enthusiasm to become an investor. We valued Victor's introductions to strategic opportunities, optimistic outlook on our expansion plans, and unwavering support for our company. Anticipating the opportunity to collaborate once more in the times ahead.

Matt Humphrey

Founder of Kiavi (LendingHome)

You have been an remarkable ally to LendingHome, offering much more than just financial support. Your expertise in scaling both technology and entire organizations has been invaluable. Your strategic connections accelerated our business forward in a number of unique ways. And your team is always there on a moment's notice when we need help. We are a better company for having partnered with you and would vigorously recommend your partnership to any founder globally.

Peter Smith

Founder and CEO of Blockchain.com

R136 Ventures has been an invaluable partner throughout Blockchain.com's journey. Their expertise and knowledge in the financial technology domain have been instrumental to our partnership, and we value their consistent support, professionalism, and collaborative approach. We look forward to deepening our partnership and eagerly anticipate achieving further milestones alongside R136 Ventures.

Mark Gazit

CEO of ThetaRay

From the beginning of our relationship five years ago, you’ve been not only an investor, but a trusted advisor and strategic partner. Guidance, supported by a blend of industry expertise, business acumen and forward-thinking approach, helped us navigate the unpredictable landscape of tech space. I greatly appreciate your faith in our vision, product, technology and potential to bring more value to the field despite all the difficulties on the way.

Kaan Gunay

Co-Founder and CEO of Firefly

Since your first investment in 2019, you have been a strong supporter throughout our journey. Our collaboration has been more than just a business transaction, your strategic insights and valuable introductions have played an important role in our growth and helped us reach significant milestones. I am truly grateful that you saw immense potential in us, your backing ensured our steady progression amidst all the challenges.

Shahar Fogel

CEO of Rookout

Acquired

Choosing them as our lead investor in tough market conditions proved to be pivotal for us. From the onset, they’ve shown an extraordinary commitment and founder-friendly approach. A proactive position, wealth of experience and readiness to spend time and resources significantly propelled our progress. If a founder is seeking added value from investors, he/she should definitely approach them. It has resulted in the successful acquisition of the company through which they provided every support and guidance required.

Yonatan Geifman

Co-Founder and CEO of Deci.ai

Despite our relatively short cooperation, they’ve proven to be a trusted partner, who backed us again in a period of market turbulence and heightened uncertainty. Apart from financial support they provided us with a wide network that brought new opportunities to expand our pipeline, and contributed immensely to our strategic decision-making processes.

Field Notes From

Growth‑Stage Trenches

Raw insights from the trenches of scaling companies.

No fluff, no theory – just what actually works.

Raw insights from the trenches of scaling companies. No fluff, no theory – just what actually works.

See More

Victor Orlovski

Feb 25, 2026

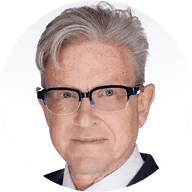

R136 Ventures Growth Digest #9: The Market Picks Sides, xAI-SpaceX Merger, Hard Infrastructure Leads

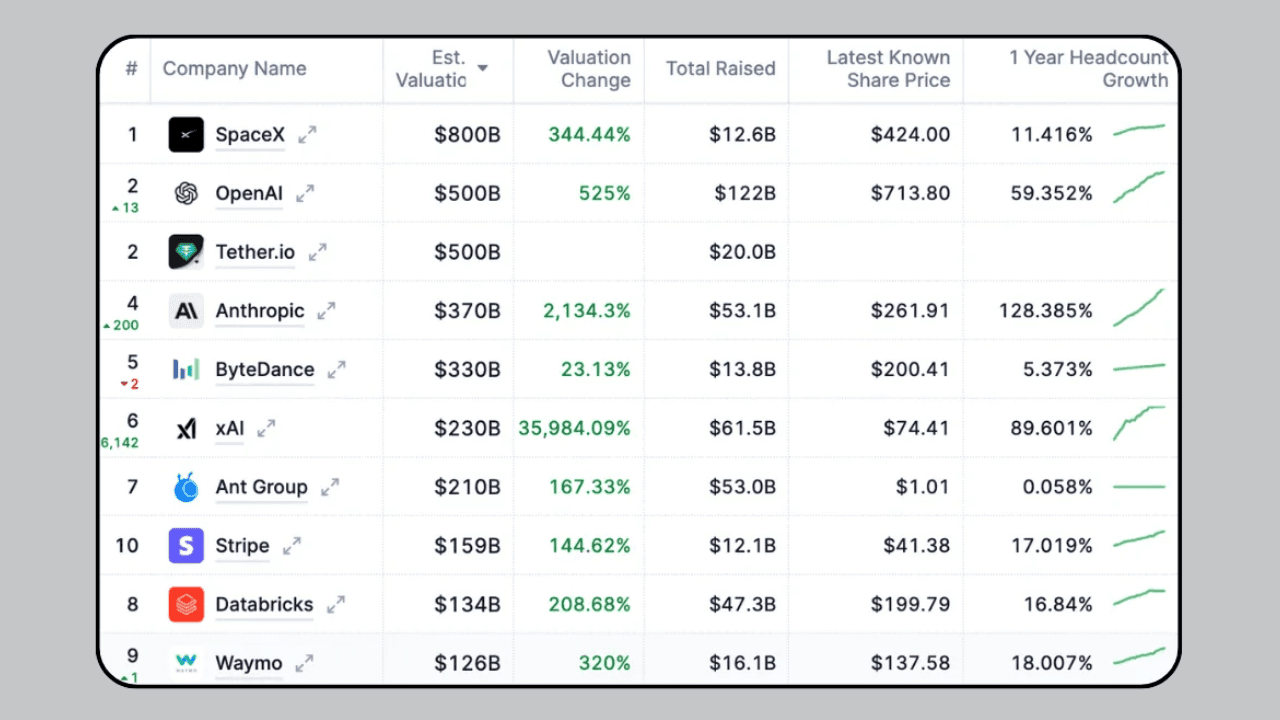

Hey folks, welcome to February’s newsletter, where we track what matters in late-stage venture. The market isn't rising, it's splitting. February's rounds made that cleaner: tier-1 capital went to hard infrastructure and AI with real moats, while everything else competed on fundamentals and hope.

Victor Orlovski

Feb 26, 2026

I'm now more skeptical of great demos than mediocre ones.

It used to mean a team solved a genuinely hard technical problem and you were looking at something real and durable. Not anymore. Almost anyone can ship a solid prototype in a weekend now. A demo can tell you about a founder's ambition..but almost nothing about the company's durability.

Pavel Prata

Feb 10, 2026

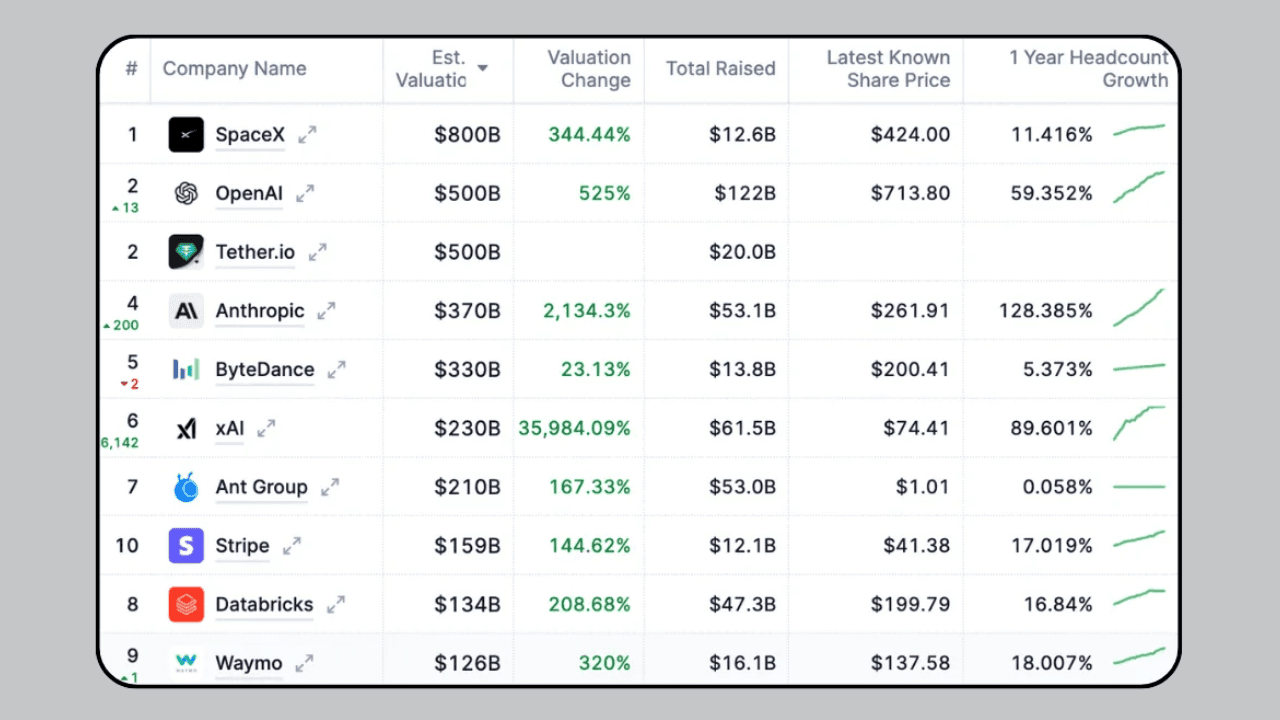

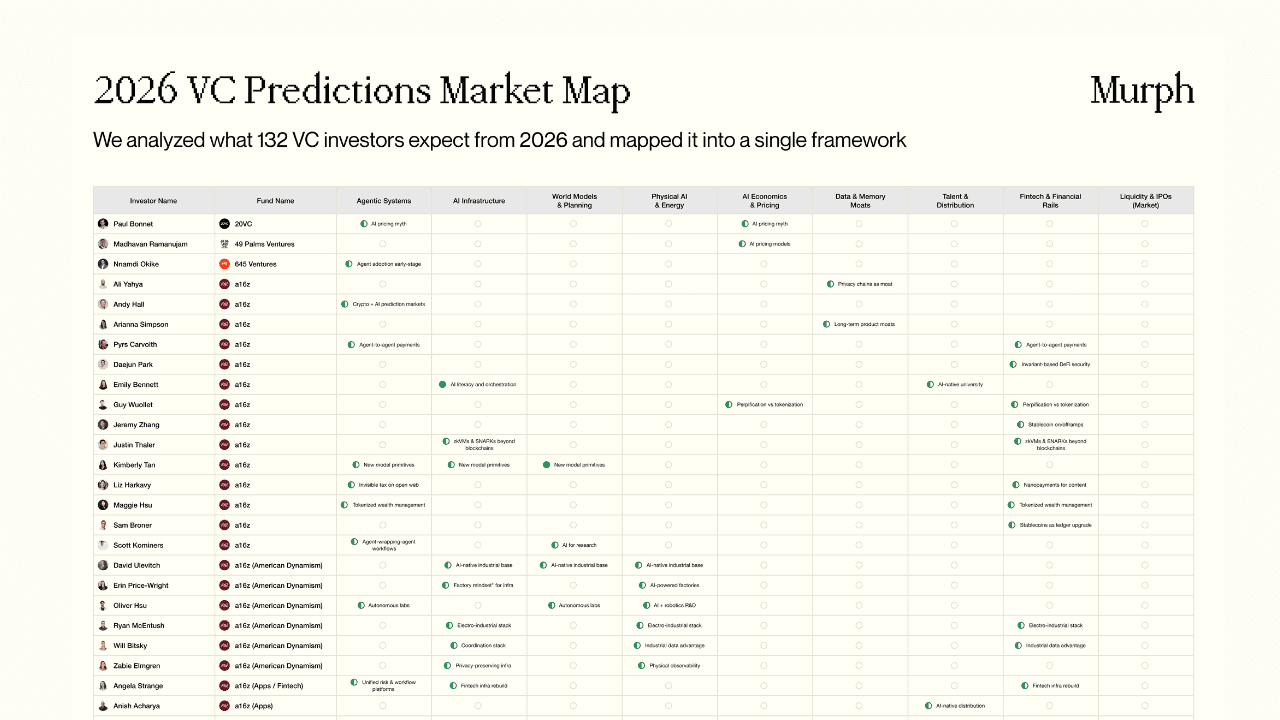

2026 VC Predictions Market Map

Starting in December 2025 and continuing into early 2026, I began to notice how deeply the market had slipped into what I’d call “prediction mode” – a state where almost everyone felt compelled to publicly articulate their version of the future, even when that future was still highly uncertain.

Pavel Prata

Feb 26, 2026

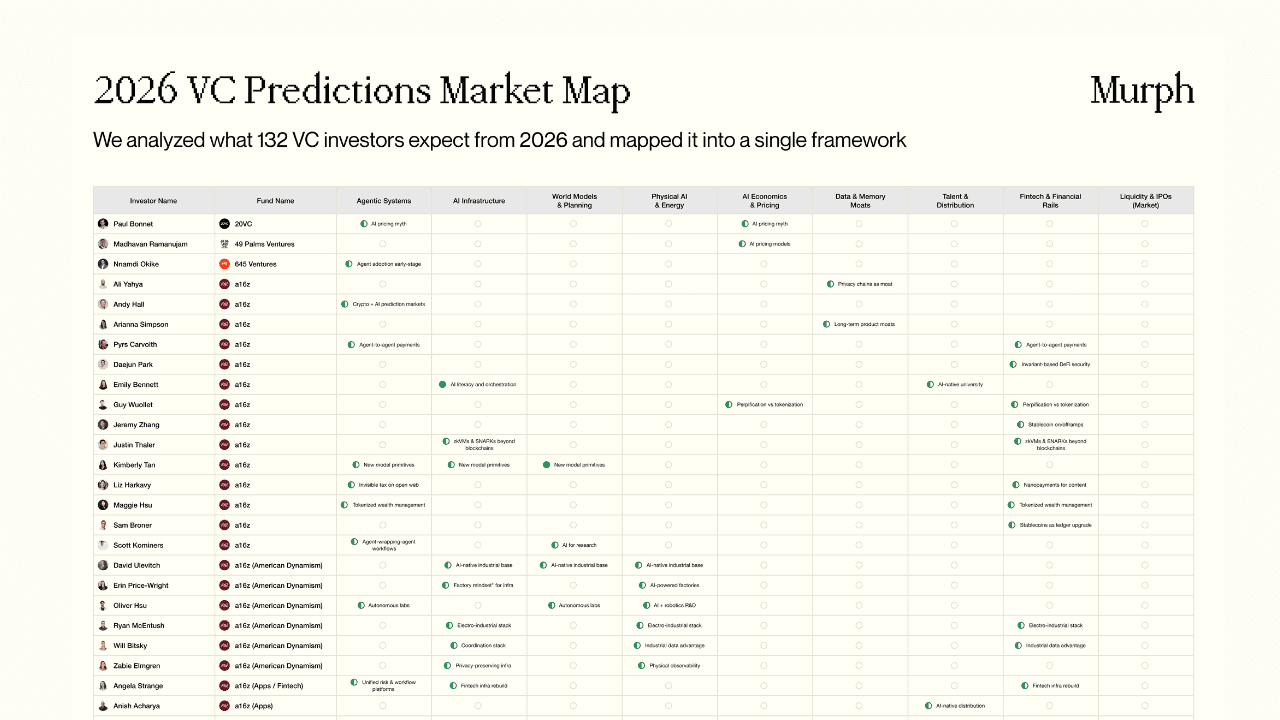

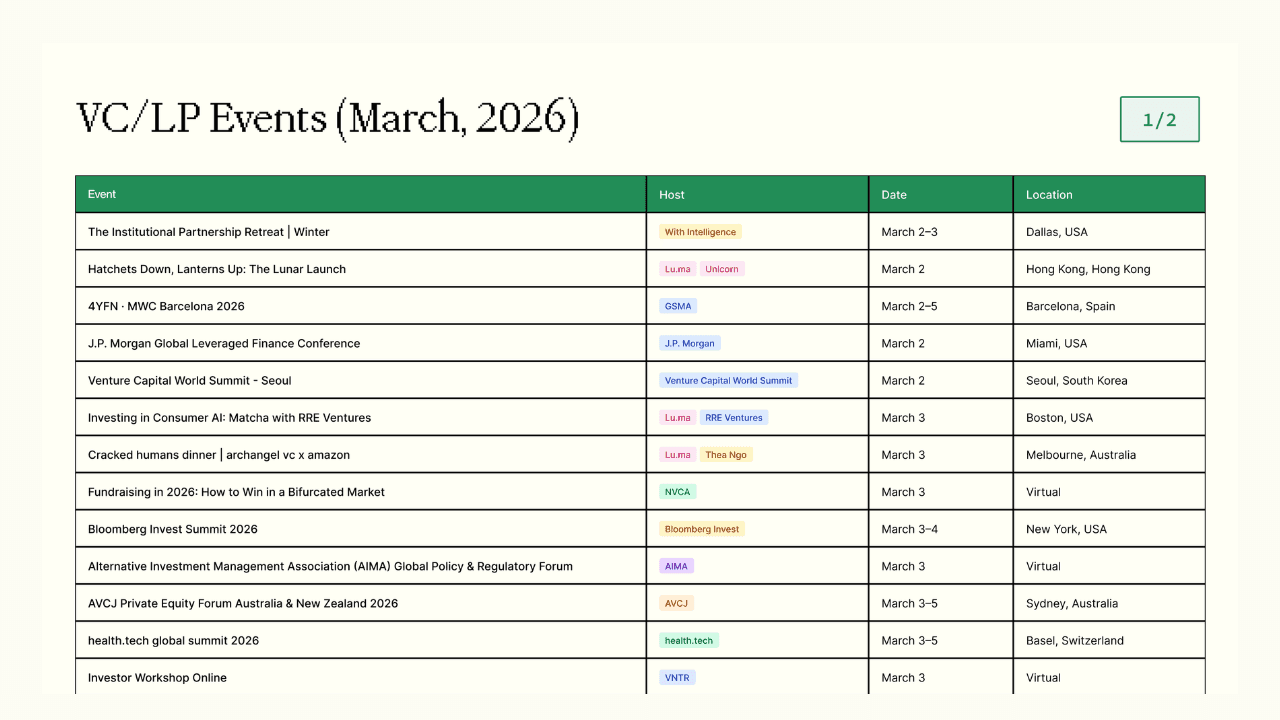

I've collected every major VC/LP event for March 2026.

121 events. 6 continents. Here's what the data reveals. See the full table with filters, hosts & direct links. Which event are you hitting?

Denis Efremov

Feb 20, 2026

I’m tired of "ghost" connection requests and contacts on LinkedIn. Aren’t you?

Every week, I receive dozens of connection requests. LinkedIn is advising to only connect with people you know. But we all know that hasn't been the case for a long time. Everyone sends invites to strangers. Everyone is "building their network.”

R136 Ventures

Feb 27, 2026

February 2026 Portfolio Recap 📊

Even though February is the shortest month of the year, the list of achievements from our portfolio keeps getting longer and longer.Here’s what happened this month.

Forbes

Jan 7, 2026

Why General-Purpose AI Coding Tools Are Losing Ground

The annual recurring revenue (ARR) numbers for AI coding tools look like a rocket ship. Cursor hit $500 million ARR, and Lovable went from $17 million in February to $75 million by July. On paper, this looks like unstoppable momentum.

The AI Inflection: Key Highlights and Trends for 2026

November 18, 2025 // 9 AM – 11 AM (PST)

Denis Efremov

Feb 12, 2026

Europe Creates More Founders Than the US

Curious whether VCs fail at providing value? This data comes from the 2025 State of European Tech report by Atomico. Atomico regularly asks founders what value investors provide to startups.

Victor Orlovski

Feb 25, 2026

R136 Ventures Growth Digest #9: The Market Picks Sides, xAI-SpaceX Merger, Hard Infrastructure Leads

Hey folks, welcome to February’s newsletter, where we track what matters in late-stage venture. The market isn't rising, it's splitting. February's rounds made that cleaner: tier-1 capital went to hard infrastructure and AI with real moats, while everything else competed on fundamentals and hope.

Victor Orlovski

Feb 26, 2026

I'm now more skeptical of great demos than mediocre ones.

It used to mean a team solved a genuinely hard technical problem and you were looking at something real and durable. Not anymore. Almost anyone can ship a solid prototype in a weekend now. A demo can tell you about a founder's ambition..but almost nothing about the company's durability.

Pavel Prata

Feb 10, 2026

2026 VC Predictions Market Map

Starting in December 2025 and continuing into early 2026, I began to notice how deeply the market had slipped into what I’d call “prediction mode” – a state where almost everyone felt compelled to publicly articulate their version of the future, even when that future was still highly uncertain.

Pavel Prata

Feb 26, 2026

I've collected every major VC/LP event for March 2026.

121 events. 6 continents. Here's what the data reveals. See the full table with filters, hosts & direct links. Which event are you hitting?

Denis Efremov

Feb 20, 2026

I’m tired of "ghost" connection requests and contacts on LinkedIn. Aren’t you?

Every week, I receive dozens of connection requests. LinkedIn is advising to only connect with people you know. But we all know that hasn't been the case for a long time. Everyone sends invites to strangers. Everyone is "building their network.”

Join our newsletter to receive growth-stage insights straight to your inbox

Join our newsletter to receive growth-stage insights straight to your inbox

Join our newsletter to receive growth-stage insights straight to your inbox

© 2025 All rights reserved.

Silicon Valley

2925 Woodside Rd,

Woodside, CA 94062

Tel Aviv

37 Menachem Begin Rd. Rubinstein House

Tel Aviv 6522042

Dubai

Dubai Silicon Oasis, DDP, Building A2 IFZA

Business Park Dubai, U.A.E.

© 2025 All rights reserved.

Silicon Valley

2925 Woodside Rd,

Woodside, CA 94062

Tel Aviv

37 Menachem Begin Rd. Rubinstein House

Tel Aviv 6522042

Dubai

Dubai Silicon Oasis, DDP, Building A2 IFZA

Business Park Dubai, U.A.E.